A Guide to Private Pay Home Care for Older Adults

Dec 2, 2024

Dec 2, 2024

As we age, remaining independent and staying in the comfort of our own homes can be an important goal; in fact, aging in place has been linked to higher quality of life, increased social connectedness and lower healthcare costs.

Yet, managing daily activities and healthcare needs often requires extra support with age.

This guide explores private pay home care, a customizable service that helps individuals live safely and comfortably at home. We’ll cover the types of services available, factors that affect costs, payment options, and detailed steps to help you select the right care.

What is Private Pay Home Care?

Private pay home care, sometimes referred to as private duty home care, includes services paid for out of pocket. These services offer flexibility, allowing you to customize care based on individual needs—whether it’s help with daily tasks, mobility, or ongoing medical assistance.

Definition and Overview

To make informed decisions about private pay home care, it helps to understand a few key terms:

Private Pay Services: Caregiving, medical assistance, and household support provided in the home, typically not covered by insurance.

Provider: A trained caregiver—such as a nurse, personal care assistant (PCA), homemaker, or home health aide—who provides support in the home.

Activities of Daily Living (ADLs): Essential tasks like dressing, bathing, grooming, cooking, and cleaning that some individuals may need help with.

Common Services Provided

Private pay home care covers a wide range of services, allowing you to tailor the care to match specific needs:

Nursing Care: Provides skilled support for tasks such as medication management, wound care, and vital sign monitoring. Nursing care is ideal if there are ongoing medical needs.

Personal Care Assistant (PCA): PCAs assist with ADLs, like bathing, dressing, and mobility. Some PCAs are not certified to administer medications, so confirm the provider’s qualifications if medication assistance is necessary.

Homemaking: Homemaking support includes cleaning, laundry, and meal preparation, which can relieve burdens on individuals who need help at home. Many homemakers also offer companionship, valuable for individuals who live alone.

Respite Care: Respite care is short-term in-home or facility-based care that allows primary caregivers to take a break. Most respite care is arranged for 1–2 weeks, providing family caregivers with essential time to recharge.

To select the right level of care, start by identifying specific needs. Make a list of tasks your loved one finds challenging (e.g., bathing, cooking, cleaning), and consider their social and medical needs.

You can read more about how to hire a home health aide in Clara's step-by-step guide, here.

Pros and Cons of Private Pay Home Care

When considering private pay home care, it’s essential to weigh the benefits and challenges to ensure it’s the right choice for your family. Private pay home care offers flexibility and personalized support, but it also comes with certain responsibilities and costs.

Here’s a closer look at the pros and cons, along with ways that Clara Home Care can help simplify the process and address common concerns.

Pros

Personalized Care: Private pay home care allows families to customize services based on specific needs, whether it’s support with daily activities, companionship, or medical care.

Flexible Scheduling: Families can choose the amount of care needed, from occasional help to full-time assistance, based on the individual’s requirements and budget.

Familiar Environment: Staying at home provides comfort and stability, which can be especially beneficial for older adults and those with cognitive challenges.

Increased Independence: By receiving care at home, individuals maintain greater control over their routines, personal space, and daily activities.

Continuity of Care: Working with the same caregivers consistently helps build trust and ensures high-quality, reliable support.

Cons

Administrative Burden: Managing payroll, taxes, and scheduling for caregivers can be complex and time-consuming. Clara Home Care takes care of all these administrative tasks, handling payroll, tax filings, and compliance, so families can focus on quality care rather than logistics. You can read more about the importance of paying your caregiver legally here.

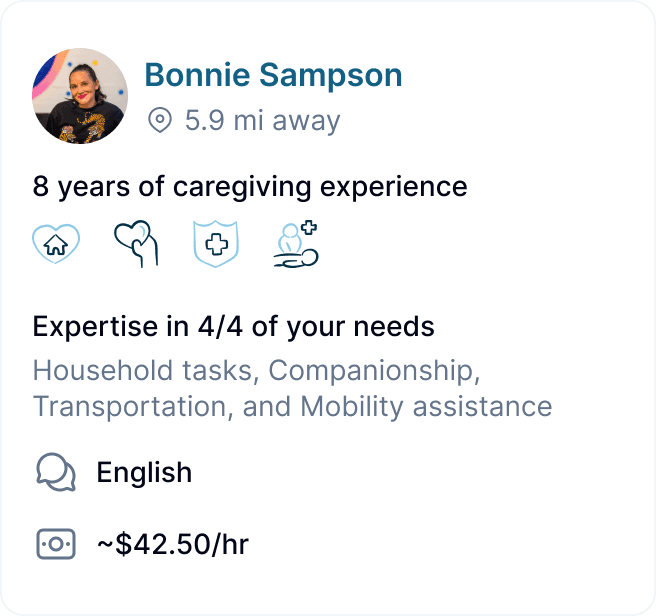

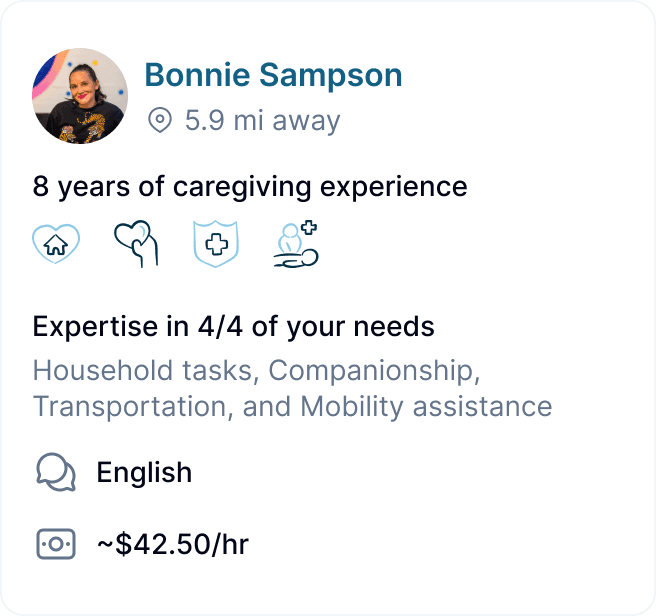

Finding Qualified Caregivers: Sourcing and vetting caregivers to ensure safety and reliability can be challenging. Clara simplifies this by connecting families with highly vetted, experienced caregivers, saving time and providing peace of mind.

Higher Out-of-Pocket Costs: Since private pay home care is generally not covered by insurance, families often face higher out-of-pocket expenses. Clara offers transparent, flexible pricing options to help families budget and customize care.

Limited Coverage in Rural Areas: In rural regions, finding caregivers may be difficult, and services may be limited. Clara’s caregiver network includes flexible options for families in various locations, ensuring access to support where it’s needed.

By choosing Clara Home Care, families can overcome many of the administrative and logistical challenges associated with private pay home care, allowing them to focus on quality, personalized support without added burdens.

Who Typically Uses Private Pay Home Care?

Private pay home care can benefit a wide range of individuals:

Older adults needing assistance with ADLs due to age, chronic illness, or cognitive decline.

Individuals recovering from surgery who require temporary, in-home support to ensure a safe recovery.

Those managing medical devices such as ventilators, IVs, or feeding tubes.

Individuals preferring end-of-life care at home, often alongside hospice support.

Primary caregivers who need temporary relief through respite care to balance their other responsibilities.

If you think private pay home care may be right for your family, consider making a detailed list of specific needs and priorities. This list can streamline conversations with providers and ensure services align with your loved one’s requirements.

Factors Affecting Costs of Private Pay Home Care

Understanding what affects private pay home care costs can help you make a realistic budget. The main cost factors are typically the type of care, duration and frequency, and location.

Type of Care Needed

Costs vary based on the services required, which are generally assessed during an in-home evaluation. Assessments by a registered nurse (RN) will review:

Physical and mental health needs.

Ability to perform ADLs independently.

Any specific medical or specialized care requirements.

During this assessment, ask questions about service flexibility and verify that the agency can adjust care as your loved one’s needs change.

Duration and Frequency of Care

The hours and regularity of care also impact overall costs. Here’s how to plan for duration and frequency:

Duration: The number of hours required per session can vary. If your loved one only needs occasional help, consider hourly care. If daily support is needed, discuss longer sessions.

Frequency: Some agencies provide bundled rates (daily, weekly, or monthly). Confirm the hours covered by each package to make sure they align with your needs. If long-term care is necessary, ask about discounts for ongoing services.

These adjustments in duration and frequency make it easier to budget and ensure that your loved one has the support they need.

Geographic Location

Location can significantly impact the availability and pricing of private pay home care. Larger cities generally have more providers, which can sometimes lower costs due to competition, while rural areas may have fewer options, often leading to higher rates.

To find the best care options for your area, consider reaching out to a service like Clara Home Care, which provides trusted, flexible in-home support designed to meet your loved one’s needs. Clara’s caregivers offer quality care without the need for multiple agency comparisons. Alternatively, you can contact local agencies, review their services, availability, and rates, or seek recommendations from healthcare providers to ensure you find reliable support.

Average Costs of Private Pay Home Care

Here’s a cost breakdown to help you plan a budget for private pay home care:

Hourly Rates

As of 2023, average hourly rates for private pay home care services are as follows (note that these vary considerably by location):

Registered nurse: $41.38 per hour

Home health aide or PCA: $16.12 per hour

You can also use tools like this to estimate the cost of care in your area.

Monthly and Annual Costs

For consistent, ongoing care, some agencies offer weekly or monthly packages that may provide slight savings. Always confirm package details with each provider to find the best fit. While some agencies offer discounts for higher hour commitments, not all do, so ask for specifics.

Additional Fees

Many agencies may charge additional fees, so it’s helpful to clarify these in advance:

Provider sick days or missed shifts: Ask if you’re reimbursed for missed hours or if you’ll still be charged.

Outings with PCAs: If a PCA accompanies you on outings, find out who covers their meals, tickets, or other fees.

Anticipating these needs can help you budget more accurately and avoid unexpected charges.

Cost Comparisons

When evaluating private pay home care, it’s helpful to compare costs with other care options to better understand value:

Experience and Skill Level: For tasks involving only ADL support, a PCA may suffice, which can reduce costs. More complex needs may require a nurse, which would be pricier but may be essential.

Skilled Nursing Facilities: Skilled nursing facilities typically cost $8,000–$10,000 per month, whereas 24/7 in-home nursing can cost over $360,000 annually.

For location-specific information on skilled nursing costs, use the CMS Care Compare tool. Contacting facilities directly can also provide insights into rates and payment options.

Payment Options and Strategies

Funding private pay home care can be challenging, but there are several strategies and assistance programs that may help.

Out-of-Pocket Payment

Since private pay services are often not covered by insurance, many families pay out of pocket. If you anticipate applying for financial aid later, keep all receipts and payment records, as some assistance programs may reimburse previous expenses.

For easier management, consider setting up a dedicated account or expense tracker specifically for home care expenses. This system can simplify the reimbursement process if you eventually apply for aid.

Long-Term Care Insurance

Long-term care insurance can offset some or all private pay home care costs. Since coverage varies, review your plan’s terms to understand any out-of-pocket requirements and coverage limitations.

If you’re uncertain about policy details, schedule a meeting with your insurance agent. They can clarify what’s needed if you decide to activate your benefits and help avoid surprises.

Financial Assistance and Community Resources

Several assistance programs may be available, especially for those meeting specific eligibility requirements:

Government Programs: Medicaid may cover in-home care for eligible individuals. Visit Medicaid.gov to check requirements in your state. Additionally, Medicare may cover limited home health care for qualified individuals, which you can explore further at Medicare.gov.

Local Area Agencies on Aging (AAAs): Area Agencies on Aging provide services that include meal programs, in-home support, and respite care. Find your local AAA through the Eldercare Locator or call the national helpline at 1-800-677-1116.

Community and Faith-Based Organizations: Some faith organizations and local community centers offer low-cost companionship, transportation, and respite services. Contact local centers and places of worship, as these programs are often under-publicized but can be immensely helpful.

When pursuing community resources, it’s useful to call each agency or organization directly, as some programs may have limited capacity or require specific eligibility criteria.

Applying for Aid

If you’re applying for financial assistance, gather essential documentation in advance, including:

Medical diagnoses or care requirements.

Bank statements showing income and assets.

Records of other financial assets like pensions or stocks.

This paperwork helps demonstrate financial need, supporting your application for aid and expediting the review process.

Private Pay In-Home Care: Next Steps Checklist

Ready to take the next steps in exploring private pay home care? Here’s a step-by-step list to guide you:

Arrange an In-Home Assessment: Many home care agencies provide an initial in-home assessment to evaluate specific needs and determine the right level of care. Contact local agencies or healthcare providers to schedule an assessment by a registered nurse for an accurate care plan and cost estimate.

Compare Providers: Use resources like Care Compare to research local nursing and home care options. Clara Home Care, with its network of trusted caregivers and flexible care packages, offers quality in-home support that’s designed to meet individual needs affordably.

Research Financial Assistance Options:

Review eligibility requirements for Medicaid to see if you qualify for in-home care coverage.

Visit Medicare.gov to determine if you or your loved one qualifies for Medicare-covered home health services.

Locate your Area Agency on Aging through the Eldercare Locator or call 1-800-677-1116 to inquire about local resources, meal programs, and respite care.

Contact Community Organizations: Reach out to community centers, local health departments, or nearby places of worship for volunteer or low-cost care options, such as companionship, transportation, or respite services, providing additional support at minimal to no cost.

Review Long-Term Care Insurance: If you have a long-term care insurance policy, review the terms with your insurance provider to understand coverage limits and out-of-pocket requirements. This preparation will help you make the most of your benefits for future care needs.

Set Up a Budget and Track Expenses: Create a dedicated bank account or use an expense tracker to organize home care payments and related costs. This will simplify record-keeping, especially if you plan to apply for financial assistance or reimbursement later.

Each of these steps will bring you closer to a well-planned care arrangement that balances quality, flexibility, and affordability.

Final Thoughts

Choosing private pay home care is a major decision, and balancing quality with affordability can bring peace of mind.

Clara Home Care simplifies this process by managing hiring, payroll, and taxes, so families can focus on the well-being of their loved ones. With an extensive network of trusted caregivers and flexible packages, Clara Home Care helps families confidently choose the best support for their needs.

For more guidance on managing costs, see our article on funding options for private pay home care. Clara’s support ensures reliable care options without added administrative burdens, so you can focus on what matters most.

This article was reviewed and fact-checked by Megan Jones, MSW, LSWAIC.

Sources

U.S. Bureau of Labor Statistics. "Registered Nurses." Occupational Outlook Handbook, 2024, www.bls.gov/ooh/healthcare/registered-nurses.htm.

U.S. Bureau of Labor Statistics. "Home Health and Personal Care Aides." Occupational Outlook Handbook, 2024, www.bls.gov/ooh/healthcare/home-health-aides-and-personal-care-aides.htm.

Van Dis, Katie. "Home Health and Personal Care Aides." National Council on Aging, 23 Oct. 2023, www.ncoa.org/adviser/local-care/nursing-homes-costs/

As we age, remaining independent and staying in the comfort of our own homes can be an important goal; in fact, aging in place has been linked to higher quality of life, increased social connectedness and lower healthcare costs.

Yet, managing daily activities and healthcare needs often requires extra support with age.

This guide explores private pay home care, a customizable service that helps individuals live safely and comfortably at home. We’ll cover the types of services available, factors that affect costs, payment options, and detailed steps to help you select the right care.

What is Private Pay Home Care?

Private pay home care, sometimes referred to as private duty home care, includes services paid for out of pocket. These services offer flexibility, allowing you to customize care based on individual needs—whether it’s help with daily tasks, mobility, or ongoing medical assistance.

Definition and Overview

To make informed decisions about private pay home care, it helps to understand a few key terms:

Private Pay Services: Caregiving, medical assistance, and household support provided in the home, typically not covered by insurance.

Provider: A trained caregiver—such as a nurse, personal care assistant (PCA), homemaker, or home health aide—who provides support in the home.

Activities of Daily Living (ADLs): Essential tasks like dressing, bathing, grooming, cooking, and cleaning that some individuals may need help with.

Common Services Provided

Private pay home care covers a wide range of services, allowing you to tailor the care to match specific needs:

Nursing Care: Provides skilled support for tasks such as medication management, wound care, and vital sign monitoring. Nursing care is ideal if there are ongoing medical needs.

Personal Care Assistant (PCA): PCAs assist with ADLs, like bathing, dressing, and mobility. Some PCAs are not certified to administer medications, so confirm the provider’s qualifications if medication assistance is necessary.

Homemaking: Homemaking support includes cleaning, laundry, and meal preparation, which can relieve burdens on individuals who need help at home. Many homemakers also offer companionship, valuable for individuals who live alone.

Respite Care: Respite care is short-term in-home or facility-based care that allows primary caregivers to take a break. Most respite care is arranged for 1–2 weeks, providing family caregivers with essential time to recharge.

To select the right level of care, start by identifying specific needs. Make a list of tasks your loved one finds challenging (e.g., bathing, cooking, cleaning), and consider their social and medical needs.

You can read more about how to hire a home health aide in Clara's step-by-step guide, here.

Pros and Cons of Private Pay Home Care

When considering private pay home care, it’s essential to weigh the benefits and challenges to ensure it’s the right choice for your family. Private pay home care offers flexibility and personalized support, but it also comes with certain responsibilities and costs.

Here’s a closer look at the pros and cons, along with ways that Clara Home Care can help simplify the process and address common concerns.

Pros

Personalized Care: Private pay home care allows families to customize services based on specific needs, whether it’s support with daily activities, companionship, or medical care.

Flexible Scheduling: Families can choose the amount of care needed, from occasional help to full-time assistance, based on the individual’s requirements and budget.

Familiar Environment: Staying at home provides comfort and stability, which can be especially beneficial for older adults and those with cognitive challenges.

Increased Independence: By receiving care at home, individuals maintain greater control over their routines, personal space, and daily activities.

Continuity of Care: Working with the same caregivers consistently helps build trust and ensures high-quality, reliable support.

Cons

Administrative Burden: Managing payroll, taxes, and scheduling for caregivers can be complex and time-consuming. Clara Home Care takes care of all these administrative tasks, handling payroll, tax filings, and compliance, so families can focus on quality care rather than logistics. You can read more about the importance of paying your caregiver legally here.

Finding Qualified Caregivers: Sourcing and vetting caregivers to ensure safety and reliability can be challenging. Clara simplifies this by connecting families with highly vetted, experienced caregivers, saving time and providing peace of mind.

Higher Out-of-Pocket Costs: Since private pay home care is generally not covered by insurance, families often face higher out-of-pocket expenses. Clara offers transparent, flexible pricing options to help families budget and customize care.

Limited Coverage in Rural Areas: In rural regions, finding caregivers may be difficult, and services may be limited. Clara’s caregiver network includes flexible options for families in various locations, ensuring access to support where it’s needed.

By choosing Clara Home Care, families can overcome many of the administrative and logistical challenges associated with private pay home care, allowing them to focus on quality, personalized support without added burdens.

Who Typically Uses Private Pay Home Care?

Private pay home care can benefit a wide range of individuals:

Older adults needing assistance with ADLs due to age, chronic illness, or cognitive decline.

Individuals recovering from surgery who require temporary, in-home support to ensure a safe recovery.

Those managing medical devices such as ventilators, IVs, or feeding tubes.

Individuals preferring end-of-life care at home, often alongside hospice support.

Primary caregivers who need temporary relief through respite care to balance their other responsibilities.

If you think private pay home care may be right for your family, consider making a detailed list of specific needs and priorities. This list can streamline conversations with providers and ensure services align with your loved one’s requirements.

Factors Affecting Costs of Private Pay Home Care

Understanding what affects private pay home care costs can help you make a realistic budget. The main cost factors are typically the type of care, duration and frequency, and location.

Type of Care Needed

Costs vary based on the services required, which are generally assessed during an in-home evaluation. Assessments by a registered nurse (RN) will review:

Physical and mental health needs.

Ability to perform ADLs independently.

Any specific medical or specialized care requirements.

During this assessment, ask questions about service flexibility and verify that the agency can adjust care as your loved one’s needs change.

Duration and Frequency of Care

The hours and regularity of care also impact overall costs. Here’s how to plan for duration and frequency:

Duration: The number of hours required per session can vary. If your loved one only needs occasional help, consider hourly care. If daily support is needed, discuss longer sessions.

Frequency: Some agencies provide bundled rates (daily, weekly, or monthly). Confirm the hours covered by each package to make sure they align with your needs. If long-term care is necessary, ask about discounts for ongoing services.

These adjustments in duration and frequency make it easier to budget and ensure that your loved one has the support they need.

Geographic Location

Location can significantly impact the availability and pricing of private pay home care. Larger cities generally have more providers, which can sometimes lower costs due to competition, while rural areas may have fewer options, often leading to higher rates.

To find the best care options for your area, consider reaching out to a service like Clara Home Care, which provides trusted, flexible in-home support designed to meet your loved one’s needs. Clara’s caregivers offer quality care without the need for multiple agency comparisons. Alternatively, you can contact local agencies, review their services, availability, and rates, or seek recommendations from healthcare providers to ensure you find reliable support.

Average Costs of Private Pay Home Care

Here’s a cost breakdown to help you plan a budget for private pay home care:

Hourly Rates

As of 2023, average hourly rates for private pay home care services are as follows (note that these vary considerably by location):

Registered nurse: $41.38 per hour

Home health aide or PCA: $16.12 per hour

You can also use tools like this to estimate the cost of care in your area.

Monthly and Annual Costs

For consistent, ongoing care, some agencies offer weekly or monthly packages that may provide slight savings. Always confirm package details with each provider to find the best fit. While some agencies offer discounts for higher hour commitments, not all do, so ask for specifics.

Additional Fees

Many agencies may charge additional fees, so it’s helpful to clarify these in advance:

Provider sick days or missed shifts: Ask if you’re reimbursed for missed hours or if you’ll still be charged.

Outings with PCAs: If a PCA accompanies you on outings, find out who covers their meals, tickets, or other fees.

Anticipating these needs can help you budget more accurately and avoid unexpected charges.

Cost Comparisons

When evaluating private pay home care, it’s helpful to compare costs with other care options to better understand value:

Experience and Skill Level: For tasks involving only ADL support, a PCA may suffice, which can reduce costs. More complex needs may require a nurse, which would be pricier but may be essential.

Skilled Nursing Facilities: Skilled nursing facilities typically cost $8,000–$10,000 per month, whereas 24/7 in-home nursing can cost over $360,000 annually.

For location-specific information on skilled nursing costs, use the CMS Care Compare tool. Contacting facilities directly can also provide insights into rates and payment options.

Payment Options and Strategies

Funding private pay home care can be challenging, but there are several strategies and assistance programs that may help.

Out-of-Pocket Payment

Since private pay services are often not covered by insurance, many families pay out of pocket. If you anticipate applying for financial aid later, keep all receipts and payment records, as some assistance programs may reimburse previous expenses.

For easier management, consider setting up a dedicated account or expense tracker specifically for home care expenses. This system can simplify the reimbursement process if you eventually apply for aid.

Long-Term Care Insurance

Long-term care insurance can offset some or all private pay home care costs. Since coverage varies, review your plan’s terms to understand any out-of-pocket requirements and coverage limitations.

If you’re uncertain about policy details, schedule a meeting with your insurance agent. They can clarify what’s needed if you decide to activate your benefits and help avoid surprises.

Financial Assistance and Community Resources

Several assistance programs may be available, especially for those meeting specific eligibility requirements:

Government Programs: Medicaid may cover in-home care for eligible individuals. Visit Medicaid.gov to check requirements in your state. Additionally, Medicare may cover limited home health care for qualified individuals, which you can explore further at Medicare.gov.

Local Area Agencies on Aging (AAAs): Area Agencies on Aging provide services that include meal programs, in-home support, and respite care. Find your local AAA through the Eldercare Locator or call the national helpline at 1-800-677-1116.

Community and Faith-Based Organizations: Some faith organizations and local community centers offer low-cost companionship, transportation, and respite services. Contact local centers and places of worship, as these programs are often under-publicized but can be immensely helpful.

When pursuing community resources, it’s useful to call each agency or organization directly, as some programs may have limited capacity or require specific eligibility criteria.

Applying for Aid

If you’re applying for financial assistance, gather essential documentation in advance, including:

Medical diagnoses or care requirements.

Bank statements showing income and assets.

Records of other financial assets like pensions or stocks.

This paperwork helps demonstrate financial need, supporting your application for aid and expediting the review process.

Private Pay In-Home Care: Next Steps Checklist

Ready to take the next steps in exploring private pay home care? Here’s a step-by-step list to guide you:

Arrange an In-Home Assessment: Many home care agencies provide an initial in-home assessment to evaluate specific needs and determine the right level of care. Contact local agencies or healthcare providers to schedule an assessment by a registered nurse for an accurate care plan and cost estimate.

Compare Providers: Use resources like Care Compare to research local nursing and home care options. Clara Home Care, with its network of trusted caregivers and flexible care packages, offers quality in-home support that’s designed to meet individual needs affordably.

Research Financial Assistance Options:

Review eligibility requirements for Medicaid to see if you qualify for in-home care coverage.

Visit Medicare.gov to determine if you or your loved one qualifies for Medicare-covered home health services.

Locate your Area Agency on Aging through the Eldercare Locator or call 1-800-677-1116 to inquire about local resources, meal programs, and respite care.

Contact Community Organizations: Reach out to community centers, local health departments, or nearby places of worship for volunteer or low-cost care options, such as companionship, transportation, or respite services, providing additional support at minimal to no cost.

Review Long-Term Care Insurance: If you have a long-term care insurance policy, review the terms with your insurance provider to understand coverage limits and out-of-pocket requirements. This preparation will help you make the most of your benefits for future care needs.

Set Up a Budget and Track Expenses: Create a dedicated bank account or use an expense tracker to organize home care payments and related costs. This will simplify record-keeping, especially if you plan to apply for financial assistance or reimbursement later.

Each of these steps will bring you closer to a well-planned care arrangement that balances quality, flexibility, and affordability.

Final Thoughts

Choosing private pay home care is a major decision, and balancing quality with affordability can bring peace of mind.

Clara Home Care simplifies this process by managing hiring, payroll, and taxes, so families can focus on the well-being of their loved ones. With an extensive network of trusted caregivers and flexible packages, Clara Home Care helps families confidently choose the best support for their needs.

For more guidance on managing costs, see our article on funding options for private pay home care. Clara’s support ensures reliable care options without added administrative burdens, so you can focus on what matters most.

This article was reviewed and fact-checked by Megan Jones, MSW, LSWAIC.

Sources

U.S. Bureau of Labor Statistics. "Registered Nurses." Occupational Outlook Handbook, 2024, www.bls.gov/ooh/healthcare/registered-nurses.htm.

U.S. Bureau of Labor Statistics. "Home Health and Personal Care Aides." Occupational Outlook Handbook, 2024, www.bls.gov/ooh/healthcare/home-health-aides-and-personal-care-aides.htm.

Van Dis, Katie. "Home Health and Personal Care Aides." National Council on Aging, 23 Oct. 2023, www.ncoa.org/adviser/local-care/nursing-homes-costs/

As we age, remaining independent and staying in the comfort of our own homes can be an important goal; in fact, aging in place has been linked to higher quality of life, increased social connectedness and lower healthcare costs.

Yet, managing daily activities and healthcare needs often requires extra support with age.

This guide explores private pay home care, a customizable service that helps individuals live safely and comfortably at home. We’ll cover the types of services available, factors that affect costs, payment options, and detailed steps to help you select the right care.

What is Private Pay Home Care?

Private pay home care, sometimes referred to as private duty home care, includes services paid for out of pocket. These services offer flexibility, allowing you to customize care based on individual needs—whether it’s help with daily tasks, mobility, or ongoing medical assistance.

Definition and Overview

To make informed decisions about private pay home care, it helps to understand a few key terms:

Private Pay Services: Caregiving, medical assistance, and household support provided in the home, typically not covered by insurance.

Provider: A trained caregiver—such as a nurse, personal care assistant (PCA), homemaker, or home health aide—who provides support in the home.

Activities of Daily Living (ADLs): Essential tasks like dressing, bathing, grooming, cooking, and cleaning that some individuals may need help with.

Common Services Provided

Private pay home care covers a wide range of services, allowing you to tailor the care to match specific needs:

Nursing Care: Provides skilled support for tasks such as medication management, wound care, and vital sign monitoring. Nursing care is ideal if there are ongoing medical needs.

Personal Care Assistant (PCA): PCAs assist with ADLs, like bathing, dressing, and mobility. Some PCAs are not certified to administer medications, so confirm the provider’s qualifications if medication assistance is necessary.

Homemaking: Homemaking support includes cleaning, laundry, and meal preparation, which can relieve burdens on individuals who need help at home. Many homemakers also offer companionship, valuable for individuals who live alone.

Respite Care: Respite care is short-term in-home or facility-based care that allows primary caregivers to take a break. Most respite care is arranged for 1–2 weeks, providing family caregivers with essential time to recharge.

To select the right level of care, start by identifying specific needs. Make a list of tasks your loved one finds challenging (e.g., bathing, cooking, cleaning), and consider their social and medical needs.

You can read more about how to hire a home health aide in Clara's step-by-step guide, here.

Pros and Cons of Private Pay Home Care

When considering private pay home care, it’s essential to weigh the benefits and challenges to ensure it’s the right choice for your family. Private pay home care offers flexibility and personalized support, but it also comes with certain responsibilities and costs.

Here’s a closer look at the pros and cons, along with ways that Clara Home Care can help simplify the process and address common concerns.

Pros

Personalized Care: Private pay home care allows families to customize services based on specific needs, whether it’s support with daily activities, companionship, or medical care.

Flexible Scheduling: Families can choose the amount of care needed, from occasional help to full-time assistance, based on the individual’s requirements and budget.

Familiar Environment: Staying at home provides comfort and stability, which can be especially beneficial for older adults and those with cognitive challenges.

Increased Independence: By receiving care at home, individuals maintain greater control over their routines, personal space, and daily activities.

Continuity of Care: Working with the same caregivers consistently helps build trust and ensures high-quality, reliable support.

Cons

Administrative Burden: Managing payroll, taxes, and scheduling for caregivers can be complex and time-consuming. Clara Home Care takes care of all these administrative tasks, handling payroll, tax filings, and compliance, so families can focus on quality care rather than logistics. You can read more about the importance of paying your caregiver legally here.

Finding Qualified Caregivers: Sourcing and vetting caregivers to ensure safety and reliability can be challenging. Clara simplifies this by connecting families with highly vetted, experienced caregivers, saving time and providing peace of mind.

Higher Out-of-Pocket Costs: Since private pay home care is generally not covered by insurance, families often face higher out-of-pocket expenses. Clara offers transparent, flexible pricing options to help families budget and customize care.

Limited Coverage in Rural Areas: In rural regions, finding caregivers may be difficult, and services may be limited. Clara’s caregiver network includes flexible options for families in various locations, ensuring access to support where it’s needed.

By choosing Clara Home Care, families can overcome many of the administrative and logistical challenges associated with private pay home care, allowing them to focus on quality, personalized support without added burdens.

Who Typically Uses Private Pay Home Care?

Private pay home care can benefit a wide range of individuals:

Older adults needing assistance with ADLs due to age, chronic illness, or cognitive decline.

Individuals recovering from surgery who require temporary, in-home support to ensure a safe recovery.

Those managing medical devices such as ventilators, IVs, or feeding tubes.

Individuals preferring end-of-life care at home, often alongside hospice support.

Primary caregivers who need temporary relief through respite care to balance their other responsibilities.

If you think private pay home care may be right for your family, consider making a detailed list of specific needs and priorities. This list can streamline conversations with providers and ensure services align with your loved one’s requirements.

Factors Affecting Costs of Private Pay Home Care

Understanding what affects private pay home care costs can help you make a realistic budget. The main cost factors are typically the type of care, duration and frequency, and location.

Type of Care Needed

Costs vary based on the services required, which are generally assessed during an in-home evaluation. Assessments by a registered nurse (RN) will review:

Physical and mental health needs.

Ability to perform ADLs independently.

Any specific medical or specialized care requirements.

During this assessment, ask questions about service flexibility and verify that the agency can adjust care as your loved one’s needs change.

Duration and Frequency of Care

The hours and regularity of care also impact overall costs. Here’s how to plan for duration and frequency:

Duration: The number of hours required per session can vary. If your loved one only needs occasional help, consider hourly care. If daily support is needed, discuss longer sessions.

Frequency: Some agencies provide bundled rates (daily, weekly, or monthly). Confirm the hours covered by each package to make sure they align with your needs. If long-term care is necessary, ask about discounts for ongoing services.

These adjustments in duration and frequency make it easier to budget and ensure that your loved one has the support they need.

Geographic Location

Location can significantly impact the availability and pricing of private pay home care. Larger cities generally have more providers, which can sometimes lower costs due to competition, while rural areas may have fewer options, often leading to higher rates.

To find the best care options for your area, consider reaching out to a service like Clara Home Care, which provides trusted, flexible in-home support designed to meet your loved one’s needs. Clara’s caregivers offer quality care without the need for multiple agency comparisons. Alternatively, you can contact local agencies, review their services, availability, and rates, or seek recommendations from healthcare providers to ensure you find reliable support.

Average Costs of Private Pay Home Care

Here’s a cost breakdown to help you plan a budget for private pay home care:

Hourly Rates

As of 2023, average hourly rates for private pay home care services are as follows (note that these vary considerably by location):

Registered nurse: $41.38 per hour

Home health aide or PCA: $16.12 per hour

You can also use tools like this to estimate the cost of care in your area.

Monthly and Annual Costs

For consistent, ongoing care, some agencies offer weekly or monthly packages that may provide slight savings. Always confirm package details with each provider to find the best fit. While some agencies offer discounts for higher hour commitments, not all do, so ask for specifics.

Additional Fees

Many agencies may charge additional fees, so it’s helpful to clarify these in advance:

Provider sick days or missed shifts: Ask if you’re reimbursed for missed hours or if you’ll still be charged.

Outings with PCAs: If a PCA accompanies you on outings, find out who covers their meals, tickets, or other fees.

Anticipating these needs can help you budget more accurately and avoid unexpected charges.

Cost Comparisons

When evaluating private pay home care, it’s helpful to compare costs with other care options to better understand value:

Experience and Skill Level: For tasks involving only ADL support, a PCA may suffice, which can reduce costs. More complex needs may require a nurse, which would be pricier but may be essential.

Skilled Nursing Facilities: Skilled nursing facilities typically cost $8,000–$10,000 per month, whereas 24/7 in-home nursing can cost over $360,000 annually.

For location-specific information on skilled nursing costs, use the CMS Care Compare tool. Contacting facilities directly can also provide insights into rates and payment options.

Payment Options and Strategies

Funding private pay home care can be challenging, but there are several strategies and assistance programs that may help.

Out-of-Pocket Payment

Since private pay services are often not covered by insurance, many families pay out of pocket. If you anticipate applying for financial aid later, keep all receipts and payment records, as some assistance programs may reimburse previous expenses.

For easier management, consider setting up a dedicated account or expense tracker specifically for home care expenses. This system can simplify the reimbursement process if you eventually apply for aid.

Long-Term Care Insurance

Long-term care insurance can offset some or all private pay home care costs. Since coverage varies, review your plan’s terms to understand any out-of-pocket requirements and coverage limitations.

If you’re uncertain about policy details, schedule a meeting with your insurance agent. They can clarify what’s needed if you decide to activate your benefits and help avoid surprises.

Financial Assistance and Community Resources

Several assistance programs may be available, especially for those meeting specific eligibility requirements:

Government Programs: Medicaid may cover in-home care for eligible individuals. Visit Medicaid.gov to check requirements in your state. Additionally, Medicare may cover limited home health care for qualified individuals, which you can explore further at Medicare.gov.

Local Area Agencies on Aging (AAAs): Area Agencies on Aging provide services that include meal programs, in-home support, and respite care. Find your local AAA through the Eldercare Locator or call the national helpline at 1-800-677-1116.

Community and Faith-Based Organizations: Some faith organizations and local community centers offer low-cost companionship, transportation, and respite services. Contact local centers and places of worship, as these programs are often under-publicized but can be immensely helpful.

When pursuing community resources, it’s useful to call each agency or organization directly, as some programs may have limited capacity or require specific eligibility criteria.

Applying for Aid

If you’re applying for financial assistance, gather essential documentation in advance, including:

Medical diagnoses or care requirements.

Bank statements showing income and assets.

Records of other financial assets like pensions or stocks.

This paperwork helps demonstrate financial need, supporting your application for aid and expediting the review process.

Private Pay In-Home Care: Next Steps Checklist

Ready to take the next steps in exploring private pay home care? Here’s a step-by-step list to guide you:

Arrange an In-Home Assessment: Many home care agencies provide an initial in-home assessment to evaluate specific needs and determine the right level of care. Contact local agencies or healthcare providers to schedule an assessment by a registered nurse for an accurate care plan and cost estimate.

Compare Providers: Use resources like Care Compare to research local nursing and home care options. Clara Home Care, with its network of trusted caregivers and flexible care packages, offers quality in-home support that’s designed to meet individual needs affordably.

Research Financial Assistance Options:

Review eligibility requirements for Medicaid to see if you qualify for in-home care coverage.

Visit Medicare.gov to determine if you or your loved one qualifies for Medicare-covered home health services.

Locate your Area Agency on Aging through the Eldercare Locator or call 1-800-677-1116 to inquire about local resources, meal programs, and respite care.

Contact Community Organizations: Reach out to community centers, local health departments, or nearby places of worship for volunteer or low-cost care options, such as companionship, transportation, or respite services, providing additional support at minimal to no cost.

Review Long-Term Care Insurance: If you have a long-term care insurance policy, review the terms with your insurance provider to understand coverage limits and out-of-pocket requirements. This preparation will help you make the most of your benefits for future care needs.

Set Up a Budget and Track Expenses: Create a dedicated bank account or use an expense tracker to organize home care payments and related costs. This will simplify record-keeping, especially if you plan to apply for financial assistance or reimbursement later.

Each of these steps will bring you closer to a well-planned care arrangement that balances quality, flexibility, and affordability.

Final Thoughts

Choosing private pay home care is a major decision, and balancing quality with affordability can bring peace of mind.

Clara Home Care simplifies this process by managing hiring, payroll, and taxes, so families can focus on the well-being of their loved ones. With an extensive network of trusted caregivers and flexible packages, Clara Home Care helps families confidently choose the best support for their needs.

For more guidance on managing costs, see our article on funding options for private pay home care. Clara’s support ensures reliable care options without added administrative burdens, so you can focus on what matters most.

This article was reviewed and fact-checked by Megan Jones, MSW, LSWAIC.

Sources

U.S. Bureau of Labor Statistics. "Registered Nurses." Occupational Outlook Handbook, 2024, www.bls.gov/ooh/healthcare/registered-nurses.htm.

U.S. Bureau of Labor Statistics. "Home Health and Personal Care Aides." Occupational Outlook Handbook, 2024, www.bls.gov/ooh/healthcare/home-health-aides-and-personal-care-aides.htm.

Van Dis, Katie. "Home Health and Personal Care Aides." National Council on Aging, 23 Oct. 2023, www.ncoa.org/adviser/local-care/nursing-homes-costs/

More about paying for care

More about paying for care

What Is The Cost Of In-Home Dementia Care In California?

Ian Gillis

Tax Benefits and Deductions for Family Caregivers: Saving Money While Providing Care

Ian Gillis

Breaking Down Financial Barriers to Senior Care: Tips and Strategies

Jon Levinson

What is Long-Term Care Insurance? How It Can Support Your Loved Ones

Vanessa Bustos

How to Tackle Tough Financial Conversations with Your Aging Parents

Jon Levinson

Home Hospice Care Costs for Older Adults: What You Need to Know

Grady Shumway, MSW, LCSW

Does Medicare Cover In-Home Care for Seniors?

Ian Gillis

Does Medicaid Cover In-Home Care for Older Adults?

Amanda Lambert, MS, CMC, ALCP

Are Caregivers Paid Overtime During the Holidays?

Lowrie Hilladakis

What Are the Costs of In-Home Nursing Care?

Grady Shumway, MSW, LCSW

GEt started for free

Better care starts with Clara.

Find, hire, and pay top-notch caregivers without the headache for a price that fits your budget.

GEt started for free

Better care starts with Clara.

Find, hire, and pay top-notch caregivers without the headache for a price that fits your budget.

GEt started for free

Better care starts with Clara.

Find, hire, and pay top-notch caregivers without the headache for a price that fits your budget.