Does Medicare Cover In-Home Care for Seniors?

Dec 31, 2024

Dec 31, 2024

Over 75% of adults over 50 want to remain at home as they age, according to an AARP "Home and Community Preferences" survey. At Clara, we want to empower every individual to make that decision for themselves. However, one of the most common questions seniors we get is: “Does Medicare cover in-home care?”

Medicare does provide coverage for certain types of in-home care, but it's important to understand the specifics:

Home Health Care vs. Standard In-Home Care

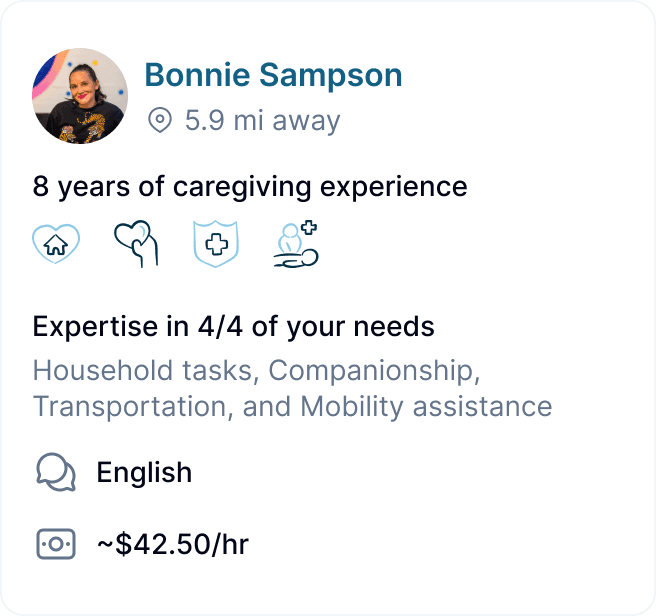

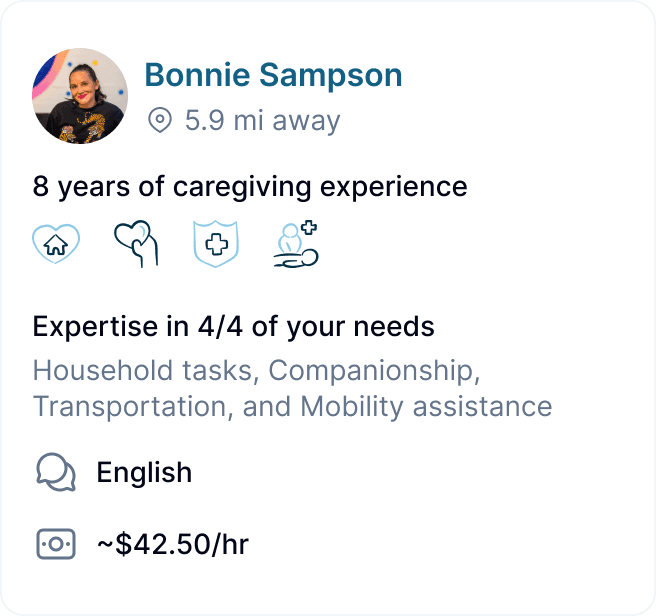

Medicare distinguishes between home health care and standard in-home care. While it generally does not cover standard in-home care, such as the kind provided by caregivers on Clara’s platform, it does cover eligible home health care services under specific circumstances.

Covered Services

Medicare will cover the following home health care services:

Skilled nursing care (part-time or intermittent)

Physical therapy

Occupational therapy

Speech-language pathology services

Medical social services

Medical supplies for use at home

Non-covered Services

Medicare will not cover a wide range of non-medical services that enable seniors to continue living safely and comfortably in their own homes. These services are typically provided by home health aides or certified nursing assistants and focus on helping elderly individuals maintain their daily routines and independence

Specific examples of in-home care services include:

Personal Care: Assistance with bathing, dressing, grooming, and toileting

Meal Preparation: Planning and cooking nutritious meals tailored to dietary needs

Light Housekeeping: Helping with laundry, dishes, and general tidying

Medication Reminders: Ensuring medications are taken as prescribed

Mobility Assistance: Helping with walking, transferring, and fall prevention

Transportation: Driving to appointments, errands, or social activities

Companionship: Engaging in conversation, games, or hobbies

Cognitive Support: Supervision and engagement for those with dementia or Alzheimer's12

Medicare-Covered Medical Equipment for Non-Medical In-Home Care Recipients

While Medicare generally doesn't cover non-medical in-home care, it does cover certain durable medical equipment (DME) that individuals receiving such care might need. Medicare Part B covers DME when prescribed by a doctor for home use and considered medically necessary.

Examples of Medicare-covered DME that might be useful for those receiving non-medical in-home care include:

Mobility Aids: Canes, walkers, wheelchairs and scooters (with additional requirements)

Bathroom Safety Equipment: Commode chairs, patient lifts

Medical Monitoring Devices: Blood sugar meters and test strips, continuous glucose monitors

Respiratory Equipment: Oxygen equipment and accessories, nebulizers and nebulizer medications, Continuous Positive Airway Pressure (CPAP) machines

Pressure-Reducing Support Surfaces: Such as specialized mattresses or overlays

Hospital Beds: For those who need to elevate their head or legs for medical reasons

It's important to note that to qualify for Medicare coverage, the equipment must be:

Durable (able to withstand repeated use)

Used for a medical reason

Generally only useful to someone who is sick or injured

Expected to last for at least 3 years

Used in the home

Additionally, the equipment must be prescribed by a Medicare-enrolled doctor or other qualified healthcare provider, and obtained from a Medicare-approved supplier.

Other Options for Financing In-Home Care

While Medicare can be helpful for certain home health care needs, it may not cover all the in-home care services you require. Here are some alternative options to consider:

Medicaid

For those with limited resources and income, Medicaid might cover the costs of in-home care. Eligibility and benefits vary by state.

Private Insurance

Some health insurance plans, particularly long-term care insurance, may cover in-home care services.

Veterans Benefits

Veterans may be eligible for in-home care benefits through the VA, including programs like Veterans Directed Care.

Reverse Mortgages

Homeowners might consider a reverse mortgage to access home equity for care costs, though it's crucial to understand the long-term implications.

Life Insurance

Some life insurance policies allow early access to death benefits for long-term care needs.

Conclusion

While Medicare does offer some coverage for home health care under specific conditions, it's important to explore all available options to ensure comprehensive care. By understanding these various funding sources, seniors and their families can make informed decisions about financing in-home care, allowing loved ones to age comfortably and safely in their own homes.

Remember, each situation is unique, so it's advisable to consult with an expert determine the best approach for your specific needs and circumstances. Get started with Clara today for a free consultation on finding and financing in-home care!

Over 75% of adults over 50 want to remain at home as they age, according to an AARP "Home and Community Preferences" survey. At Clara, we want to empower every individual to make that decision for themselves. However, one of the most common questions seniors we get is: “Does Medicare cover in-home care?”

Medicare does provide coverage for certain types of in-home care, but it's important to understand the specifics:

Home Health Care vs. Standard In-Home Care

Medicare distinguishes between home health care and standard in-home care. While it generally does not cover standard in-home care, such as the kind provided by caregivers on Clara’s platform, it does cover eligible home health care services under specific circumstances.

Covered Services

Medicare will cover the following home health care services:

Skilled nursing care (part-time or intermittent)

Physical therapy

Occupational therapy

Speech-language pathology services

Medical social services

Medical supplies for use at home

Non-covered Services

Medicare will not cover a wide range of non-medical services that enable seniors to continue living safely and comfortably in their own homes. These services are typically provided by home health aides or certified nursing assistants and focus on helping elderly individuals maintain their daily routines and independence

Specific examples of in-home care services include:

Personal Care: Assistance with bathing, dressing, grooming, and toileting

Meal Preparation: Planning and cooking nutritious meals tailored to dietary needs

Light Housekeeping: Helping with laundry, dishes, and general tidying

Medication Reminders: Ensuring medications are taken as prescribed

Mobility Assistance: Helping with walking, transferring, and fall prevention

Transportation: Driving to appointments, errands, or social activities

Companionship: Engaging in conversation, games, or hobbies

Cognitive Support: Supervision and engagement for those with dementia or Alzheimer's12

Medicare-Covered Medical Equipment for Non-Medical In-Home Care Recipients

While Medicare generally doesn't cover non-medical in-home care, it does cover certain durable medical equipment (DME) that individuals receiving such care might need. Medicare Part B covers DME when prescribed by a doctor for home use and considered medically necessary.

Examples of Medicare-covered DME that might be useful for those receiving non-medical in-home care include:

Mobility Aids: Canes, walkers, wheelchairs and scooters (with additional requirements)

Bathroom Safety Equipment: Commode chairs, patient lifts

Medical Monitoring Devices: Blood sugar meters and test strips, continuous glucose monitors

Respiratory Equipment: Oxygen equipment and accessories, nebulizers and nebulizer medications, Continuous Positive Airway Pressure (CPAP) machines

Pressure-Reducing Support Surfaces: Such as specialized mattresses or overlays

Hospital Beds: For those who need to elevate their head or legs for medical reasons

It's important to note that to qualify for Medicare coverage, the equipment must be:

Durable (able to withstand repeated use)

Used for a medical reason

Generally only useful to someone who is sick or injured

Expected to last for at least 3 years

Used in the home

Additionally, the equipment must be prescribed by a Medicare-enrolled doctor or other qualified healthcare provider, and obtained from a Medicare-approved supplier.

Other Options for Financing In-Home Care

While Medicare can be helpful for certain home health care needs, it may not cover all the in-home care services you require. Here are some alternative options to consider:

Medicaid

For those with limited resources and income, Medicaid might cover the costs of in-home care. Eligibility and benefits vary by state.

Private Insurance

Some health insurance plans, particularly long-term care insurance, may cover in-home care services.

Veterans Benefits

Veterans may be eligible for in-home care benefits through the VA, including programs like Veterans Directed Care.

Reverse Mortgages

Homeowners might consider a reverse mortgage to access home equity for care costs, though it's crucial to understand the long-term implications.

Life Insurance

Some life insurance policies allow early access to death benefits for long-term care needs.

Conclusion

While Medicare does offer some coverage for home health care under specific conditions, it's important to explore all available options to ensure comprehensive care. By understanding these various funding sources, seniors and their families can make informed decisions about financing in-home care, allowing loved ones to age comfortably and safely in their own homes.

Remember, each situation is unique, so it's advisable to consult with an expert determine the best approach for your specific needs and circumstances. Get started with Clara today for a free consultation on finding and financing in-home care!

Over 75% of adults over 50 want to remain at home as they age, according to an AARP "Home and Community Preferences" survey. At Clara, we want to empower every individual to make that decision for themselves. However, one of the most common questions seniors we get is: “Does Medicare cover in-home care?”

Medicare does provide coverage for certain types of in-home care, but it's important to understand the specifics:

Home Health Care vs. Standard In-Home Care

Medicare distinguishes between home health care and standard in-home care. While it generally does not cover standard in-home care, such as the kind provided by caregivers on Clara’s platform, it does cover eligible home health care services under specific circumstances.

Covered Services

Medicare will cover the following home health care services:

Skilled nursing care (part-time or intermittent)

Physical therapy

Occupational therapy

Speech-language pathology services

Medical social services

Medical supplies for use at home

Non-covered Services

Medicare will not cover a wide range of non-medical services that enable seniors to continue living safely and comfortably in their own homes. These services are typically provided by home health aides or certified nursing assistants and focus on helping elderly individuals maintain their daily routines and independence

Specific examples of in-home care services include:

Personal Care: Assistance with bathing, dressing, grooming, and toileting

Meal Preparation: Planning and cooking nutritious meals tailored to dietary needs

Light Housekeeping: Helping with laundry, dishes, and general tidying

Medication Reminders: Ensuring medications are taken as prescribed

Mobility Assistance: Helping with walking, transferring, and fall prevention

Transportation: Driving to appointments, errands, or social activities

Companionship: Engaging in conversation, games, or hobbies

Cognitive Support: Supervision and engagement for those with dementia or Alzheimer's12

Medicare-Covered Medical Equipment for Non-Medical In-Home Care Recipients

While Medicare generally doesn't cover non-medical in-home care, it does cover certain durable medical equipment (DME) that individuals receiving such care might need. Medicare Part B covers DME when prescribed by a doctor for home use and considered medically necessary.

Examples of Medicare-covered DME that might be useful for those receiving non-medical in-home care include:

Mobility Aids: Canes, walkers, wheelchairs and scooters (with additional requirements)

Bathroom Safety Equipment: Commode chairs, patient lifts

Medical Monitoring Devices: Blood sugar meters and test strips, continuous glucose monitors

Respiratory Equipment: Oxygen equipment and accessories, nebulizers and nebulizer medications, Continuous Positive Airway Pressure (CPAP) machines

Pressure-Reducing Support Surfaces: Such as specialized mattresses or overlays

Hospital Beds: For those who need to elevate their head or legs for medical reasons

It's important to note that to qualify for Medicare coverage, the equipment must be:

Durable (able to withstand repeated use)

Used for a medical reason

Generally only useful to someone who is sick or injured

Expected to last for at least 3 years

Used in the home

Additionally, the equipment must be prescribed by a Medicare-enrolled doctor or other qualified healthcare provider, and obtained from a Medicare-approved supplier.

Other Options for Financing In-Home Care

While Medicare can be helpful for certain home health care needs, it may not cover all the in-home care services you require. Here are some alternative options to consider:

Medicaid

For those with limited resources and income, Medicaid might cover the costs of in-home care. Eligibility and benefits vary by state.

Private Insurance

Some health insurance plans, particularly long-term care insurance, may cover in-home care services.

Veterans Benefits

Veterans may be eligible for in-home care benefits through the VA, including programs like Veterans Directed Care.

Reverse Mortgages

Homeowners might consider a reverse mortgage to access home equity for care costs, though it's crucial to understand the long-term implications.

Life Insurance

Some life insurance policies allow early access to death benefits for long-term care needs.

Conclusion

While Medicare does offer some coverage for home health care under specific conditions, it's important to explore all available options to ensure comprehensive care. By understanding these various funding sources, seniors and their families can make informed decisions about financing in-home care, allowing loved ones to age comfortably and safely in their own homes.

Remember, each situation is unique, so it's advisable to consult with an expert determine the best approach for your specific needs and circumstances. Get started with Clara today for a free consultation on finding and financing in-home care!

More about paying for care

More about paying for care

Holiday Pay: Should I Pay My Caregiver Overtime?

Jon Levinson

How Much Does Private Duty Home Care Cost?

Vanessa Bustos

What Is The Cost Of In-Home Dementia Care In California?

Ian Gillis

Tax Benefits and Deductions for Family Caregivers: Saving Money While Providing Care

Ian Gillis

Breaking Down Financial Barriers to Senior Care: Tips and Strategies

Jon Levinson

What is Long-Term Care Insurance? How It Can Support Your Loved Ones

Vanessa Bustos

How to Tackle Tough Financial Conversations with Your Aging Parents

Jon Levinson

Home Hospice Care Costs for Older Adults: What You Need to Know

Grady Shumway, MSW, LCSW

Does Medicaid Cover In-Home Care for Older Adults?

Amanda Lambert, MS, CMC, ALCP

Are Caregivers Paid Overtime During the Holidays?

Lowrie Hilladakis

GEt started for free

Better care starts with Clara.

Find, hire, and pay top-notch caregivers without the headache for a price that fits your budget.

GEt started for free

Better care starts with Clara.

Find, hire, and pay top-notch caregivers without the headache for a price that fits your budget.

GEt started for free

Better care starts with Clara.

Find, hire, and pay top-notch caregivers without the headache for a price that fits your budget.