How to Tackle Tough Financial Conversations with Your Aging Parents

Jan 14, 2025

Jan 14, 2025

Discussing finances with aging parents is challenging, but when it comes to senior care, these conversations are vital. The cost of senior care can be substantial, and planning ahead ensures your loved ones receive the care they need without unnecessary financial strain.

Whether your parents are considering in-home care, assisted living, or nursing home options, understanding the costs and navigating payment strategies is key (see our page on Paying for Care for more information on costs and payment methods).

Here’s how to approach these difficult conversations with a focus on the financial realities of senior care.

Why Discussing Senior Care Costs is Essential

Senior care costs are a significant concern for many families. Without proper planning, these expenses can quickly overwhelm personal savings and lead to difficult decisions during emergencies. Here’s why addressing this topic early is crucial:

Rising Costs: The median cost of in-home care in 2025 ranges from $25 to up to $50 per hour, translating to thousands of dollars per month for full-time assistance. Assisted living facilities average $5,665 per month nationally, while nursing homes can cost up to $9,733 monthly for a private room.

Complex Payment Options: From Medicaid and Medicare to long-term care insurance and personal savings, navigating payment options requires careful planning.

Avoiding Crisis Decisions: Proactive discussions, such as talking about Power of Attorney, allow families to plan for future needs rather than making rushed decisions during a health crisis.

How to Approach the Conversation

1. Start Early

Initiate financial discussions before your parents need intensive care. This allows time to explore options like long-term care insurance or Medicaid eligibility.

2. Choose the Right Setting

Pick a quiet time and place where everyone feels comfortable. Avoid busy or stressful periods like holidays.

3. Lead with Empathy

Frame the conversation around your concern for their well-being. For example: “I want to make sure we’re prepared for any future needs.”

4. Be Informed

Research the costs of various senior care options in your area beforehand. Tools like Genworth’s Cost of Care Survey can help you estimate expenses.

5. Involve Other Family Members

If siblings or other relatives will share caregiving responsibilities, ensure they’re part of the discussion to avoid misunderstandings later.

Breaking Down Senior Care Costs

Understanding the costs associated with different types of senior care is essential for informed decision-making. Here’s an overview:

1. In-Home Care

Hourly Rates: $25–$50 per hour nationally.

Monthly Costs: Around $5,720 for homemaker services and $6,292 for home health aides when full-time care is needed. These costs vary widely by region, and are more expensive in higher cost-of-living areas like San Francisco.

24/7 Care: Can range from $20 to $30 per hour depending on location and level of care required. You can read more about the different types of care an in-home caregiver might provide here.

In-home care allows seniors to age in place but may require additional costs for home modifications or medical equipment.

2. Assisted Living

National Median Cost: $5,665 per month as of 2024.

Additional Fees: Services like memory care or medication management can add hundreds or even thousands of dollars monthly.

Assisted living often includes housing, meals, and basic assistance but may not cover specialized medical needs.

3. Nursing Homes

Semi-Private Room: $8,929 per month on average.

Private Room: Up to $10,025 monthly.

Nursing homes provide 24/7 medical supervision but are among the most expensive options.

4. Hospice and End-of-Life Care

Costs range from $150–$400 per day depending on the level of medical support required.

Strategies for Managing Senior Care Costs

Once you’ve discussed potential costs with your parents, explore ways to manage these expenses effectively:

1. Leverage Government Programs

Medicare: Covers short-term skilled nursing or rehab after hospitalization but does not pay for long-term custodial care. While Medicare is helpful for covering medical services like physical or occupational therapy in the home, it will not cover assistance with every activities of daily living.

Medicaid: Provides extensive coverage for low-income seniors, including nursing home and some in-home care services. Medicaid program eligibility and coverage varies by state. If you believe you may be eligible, contact your local state Medicaid agency for enrollment details.

Veterans Benefits: Offers financial assistance for eligible veterans and their spouses through programs like Aid and Attendance.

2. Explore Long-Term Care Insurance

If your parents have long-term care insurance, review their policy details to understand what services are covered and any limitations. You can request a copy of your policy details anytime by contacting your insurance provider.

3. Use Personal Assets Wisely

Home equity loans or reverse mortgages can provide funds for in-home care or assisted living but should be carefully considered with professional advice.

4. Seek Nonprofit Assistance

Organizations like Area Agencies on Aging (AAA) often provide financial aid or discounted services for seniors.

Tips for Success

To ensure productive conversations about senior care costs:

Keep Discussions Focused: Stick to one topic at a time—such as in-home care costs—before moving on to broader planning.

Respect Their Independence: Emphasize that you’re there to support their wishes rather than take control.

Leverage Professional Help: Financial planners, elder law attorneys, or geriatric care consultants can provide valuable guidance. If you’re not sure where to start, Clara’s care experts are available and eager to assist in this process. Give us a call at 415-985-0926 or schedule a call to learn more about how we can help.

What If They’re Resistant?

It’s common for aging parents to resist discussing finances due to fear of losing independence or privacy concerns. If this happens:

Share real-life examples of families who faced challenges due to lack of planning.

Reassure them that these conversations are about honoring their preferences.

Suggest a meeting with a neutral third party like a financial advisor or Clara care consultant

For more strategies on overcoming resistance see our dedicated article on this topic, here.

Final Thoughts

Tackling tough financial conversations about senior care costs isn’t easy but is essential for ensuring your parents’ comfort and security as they age. By understanding the costs involved and exploring available resources, you can create a plan that meets their needs while protecting family finances.

Remember, you don’t have to navigate this alone—services like Clara Home Care offer affordable in-home care options that save families 20–30% compared to traditional agencies while providing expert support every step of the way. Planning now ensures peace of mind for everyone involved!

Discussing finances with aging parents is challenging, but when it comes to senior care, these conversations are vital. The cost of senior care can be substantial, and planning ahead ensures your loved ones receive the care they need without unnecessary financial strain.

Whether your parents are considering in-home care, assisted living, or nursing home options, understanding the costs and navigating payment strategies is key (see our page on Paying for Care for more information on costs and payment methods).

Here’s how to approach these difficult conversations with a focus on the financial realities of senior care.

Why Discussing Senior Care Costs is Essential

Senior care costs are a significant concern for many families. Without proper planning, these expenses can quickly overwhelm personal savings and lead to difficult decisions during emergencies. Here’s why addressing this topic early is crucial:

Rising Costs: The median cost of in-home care in 2025 ranges from $25 to up to $50 per hour, translating to thousands of dollars per month for full-time assistance. Assisted living facilities average $5,665 per month nationally, while nursing homes can cost up to $9,733 monthly for a private room.

Complex Payment Options: From Medicaid and Medicare to long-term care insurance and personal savings, navigating payment options requires careful planning.

Avoiding Crisis Decisions: Proactive discussions, such as talking about Power of Attorney, allow families to plan for future needs rather than making rushed decisions during a health crisis.

How to Approach the Conversation

1. Start Early

Initiate financial discussions before your parents need intensive care. This allows time to explore options like long-term care insurance or Medicaid eligibility.

2. Choose the Right Setting

Pick a quiet time and place where everyone feels comfortable. Avoid busy or stressful periods like holidays.

3. Lead with Empathy

Frame the conversation around your concern for their well-being. For example: “I want to make sure we’re prepared for any future needs.”

4. Be Informed

Research the costs of various senior care options in your area beforehand. Tools like Genworth’s Cost of Care Survey can help you estimate expenses.

5. Involve Other Family Members

If siblings or other relatives will share caregiving responsibilities, ensure they’re part of the discussion to avoid misunderstandings later.

Breaking Down Senior Care Costs

Understanding the costs associated with different types of senior care is essential for informed decision-making. Here’s an overview:

1. In-Home Care

Hourly Rates: $25–$50 per hour nationally.

Monthly Costs: Around $5,720 for homemaker services and $6,292 for home health aides when full-time care is needed. These costs vary widely by region, and are more expensive in higher cost-of-living areas like San Francisco.

24/7 Care: Can range from $20 to $30 per hour depending on location and level of care required. You can read more about the different types of care an in-home caregiver might provide here.

In-home care allows seniors to age in place but may require additional costs for home modifications or medical equipment.

2. Assisted Living

National Median Cost: $5,665 per month as of 2024.

Additional Fees: Services like memory care or medication management can add hundreds or even thousands of dollars monthly.

Assisted living often includes housing, meals, and basic assistance but may not cover specialized medical needs.

3. Nursing Homes

Semi-Private Room: $8,929 per month on average.

Private Room: Up to $10,025 monthly.

Nursing homes provide 24/7 medical supervision but are among the most expensive options.

4. Hospice and End-of-Life Care

Costs range from $150–$400 per day depending on the level of medical support required.

Strategies for Managing Senior Care Costs

Once you’ve discussed potential costs with your parents, explore ways to manage these expenses effectively:

1. Leverage Government Programs

Medicare: Covers short-term skilled nursing or rehab after hospitalization but does not pay for long-term custodial care. While Medicare is helpful for covering medical services like physical or occupational therapy in the home, it will not cover assistance with every activities of daily living.

Medicaid: Provides extensive coverage for low-income seniors, including nursing home and some in-home care services. Medicaid program eligibility and coverage varies by state. If you believe you may be eligible, contact your local state Medicaid agency for enrollment details.

Veterans Benefits: Offers financial assistance for eligible veterans and their spouses through programs like Aid and Attendance.

2. Explore Long-Term Care Insurance

If your parents have long-term care insurance, review their policy details to understand what services are covered and any limitations. You can request a copy of your policy details anytime by contacting your insurance provider.

3. Use Personal Assets Wisely

Home equity loans or reverse mortgages can provide funds for in-home care or assisted living but should be carefully considered with professional advice.

4. Seek Nonprofit Assistance

Organizations like Area Agencies on Aging (AAA) often provide financial aid or discounted services for seniors.

Tips for Success

To ensure productive conversations about senior care costs:

Keep Discussions Focused: Stick to one topic at a time—such as in-home care costs—before moving on to broader planning.

Respect Their Independence: Emphasize that you’re there to support their wishes rather than take control.

Leverage Professional Help: Financial planners, elder law attorneys, or geriatric care consultants can provide valuable guidance. If you’re not sure where to start, Clara’s care experts are available and eager to assist in this process. Give us a call at 415-985-0926 or schedule a call to learn more about how we can help.

What If They’re Resistant?

It’s common for aging parents to resist discussing finances due to fear of losing independence or privacy concerns. If this happens:

Share real-life examples of families who faced challenges due to lack of planning.

Reassure them that these conversations are about honoring their preferences.

Suggest a meeting with a neutral third party like a financial advisor or Clara care consultant

For more strategies on overcoming resistance see our dedicated article on this topic, here.

Final Thoughts

Tackling tough financial conversations about senior care costs isn’t easy but is essential for ensuring your parents’ comfort and security as they age. By understanding the costs involved and exploring available resources, you can create a plan that meets their needs while protecting family finances.

Remember, you don’t have to navigate this alone—services like Clara Home Care offer affordable in-home care options that save families 20–30% compared to traditional agencies while providing expert support every step of the way. Planning now ensures peace of mind for everyone involved!

Discussing finances with aging parents is challenging, but when it comes to senior care, these conversations are vital. The cost of senior care can be substantial, and planning ahead ensures your loved ones receive the care they need without unnecessary financial strain.

Whether your parents are considering in-home care, assisted living, or nursing home options, understanding the costs and navigating payment strategies is key (see our page on Paying for Care for more information on costs and payment methods).

Here’s how to approach these difficult conversations with a focus on the financial realities of senior care.

Why Discussing Senior Care Costs is Essential

Senior care costs are a significant concern for many families. Without proper planning, these expenses can quickly overwhelm personal savings and lead to difficult decisions during emergencies. Here’s why addressing this topic early is crucial:

Rising Costs: The median cost of in-home care in 2025 ranges from $25 to up to $50 per hour, translating to thousands of dollars per month for full-time assistance. Assisted living facilities average $5,665 per month nationally, while nursing homes can cost up to $9,733 monthly for a private room.

Complex Payment Options: From Medicaid and Medicare to long-term care insurance and personal savings, navigating payment options requires careful planning.

Avoiding Crisis Decisions: Proactive discussions, such as talking about Power of Attorney, allow families to plan for future needs rather than making rushed decisions during a health crisis.

How to Approach the Conversation

1. Start Early

Initiate financial discussions before your parents need intensive care. This allows time to explore options like long-term care insurance or Medicaid eligibility.

2. Choose the Right Setting

Pick a quiet time and place where everyone feels comfortable. Avoid busy or stressful periods like holidays.

3. Lead with Empathy

Frame the conversation around your concern for their well-being. For example: “I want to make sure we’re prepared for any future needs.”

4. Be Informed

Research the costs of various senior care options in your area beforehand. Tools like Genworth’s Cost of Care Survey can help you estimate expenses.

5. Involve Other Family Members

If siblings or other relatives will share caregiving responsibilities, ensure they’re part of the discussion to avoid misunderstandings later.

Breaking Down Senior Care Costs

Understanding the costs associated with different types of senior care is essential for informed decision-making. Here’s an overview:

1. In-Home Care

Hourly Rates: $25–$50 per hour nationally.

Monthly Costs: Around $5,720 for homemaker services and $6,292 for home health aides when full-time care is needed. These costs vary widely by region, and are more expensive in higher cost-of-living areas like San Francisco.

24/7 Care: Can range from $20 to $30 per hour depending on location and level of care required. You can read more about the different types of care an in-home caregiver might provide here.

In-home care allows seniors to age in place but may require additional costs for home modifications or medical equipment.

2. Assisted Living

National Median Cost: $5,665 per month as of 2024.

Additional Fees: Services like memory care or medication management can add hundreds or even thousands of dollars monthly.

Assisted living often includes housing, meals, and basic assistance but may not cover specialized medical needs.

3. Nursing Homes

Semi-Private Room: $8,929 per month on average.

Private Room: Up to $10,025 monthly.

Nursing homes provide 24/7 medical supervision but are among the most expensive options.

4. Hospice and End-of-Life Care

Costs range from $150–$400 per day depending on the level of medical support required.

Strategies for Managing Senior Care Costs

Once you’ve discussed potential costs with your parents, explore ways to manage these expenses effectively:

1. Leverage Government Programs

Medicare: Covers short-term skilled nursing or rehab after hospitalization but does not pay for long-term custodial care. While Medicare is helpful for covering medical services like physical or occupational therapy in the home, it will not cover assistance with every activities of daily living.

Medicaid: Provides extensive coverage for low-income seniors, including nursing home and some in-home care services. Medicaid program eligibility and coverage varies by state. If you believe you may be eligible, contact your local state Medicaid agency for enrollment details.

Veterans Benefits: Offers financial assistance for eligible veterans and their spouses through programs like Aid and Attendance.

2. Explore Long-Term Care Insurance

If your parents have long-term care insurance, review their policy details to understand what services are covered and any limitations. You can request a copy of your policy details anytime by contacting your insurance provider.

3. Use Personal Assets Wisely

Home equity loans or reverse mortgages can provide funds for in-home care or assisted living but should be carefully considered with professional advice.

4. Seek Nonprofit Assistance

Organizations like Area Agencies on Aging (AAA) often provide financial aid or discounted services for seniors.

Tips for Success

To ensure productive conversations about senior care costs:

Keep Discussions Focused: Stick to one topic at a time—such as in-home care costs—before moving on to broader planning.

Respect Their Independence: Emphasize that you’re there to support their wishes rather than take control.

Leverage Professional Help: Financial planners, elder law attorneys, or geriatric care consultants can provide valuable guidance. If you’re not sure where to start, Clara’s care experts are available and eager to assist in this process. Give us a call at 415-985-0926 or schedule a call to learn more about how we can help.

What If They’re Resistant?

It’s common for aging parents to resist discussing finances due to fear of losing independence or privacy concerns. If this happens:

Share real-life examples of families who faced challenges due to lack of planning.

Reassure them that these conversations are about honoring their preferences.

Suggest a meeting with a neutral third party like a financial advisor or Clara care consultant

For more strategies on overcoming resistance see our dedicated article on this topic, here.

Final Thoughts

Tackling tough financial conversations about senior care costs isn’t easy but is essential for ensuring your parents’ comfort and security as they age. By understanding the costs involved and exploring available resources, you can create a plan that meets their needs while protecting family finances.

Remember, you don’t have to navigate this alone—services like Clara Home Care offer affordable in-home care options that save families 20–30% compared to traditional agencies while providing expert support every step of the way. Planning now ensures peace of mind for everyone involved!

More about paying for care

More about paying for care

Holiday Pay: Should I Pay My Caregiver Overtime?

Jon Levinson

How Much Does Private Duty Home Care Cost?

Vanessa Bustos

What Is The Cost Of In-Home Dementia Care In California?

Ian Gillis

Tax Benefits and Deductions for Family Caregivers: Saving Money While Providing Care

Ian Gillis

Breaking Down Financial Barriers to Senior Care: Tips and Strategies

Jon Levinson

What is Long-Term Care Insurance? How It Can Support Your Loved Ones

Vanessa Bustos

Home Hospice Care Costs for Older Adults: What You Need to Know

Grady Shumway, MSW, LCSW

Does Medicare Cover In-Home Care for Seniors?

Ian Gillis

Does Medicaid Cover In-Home Care for Older Adults?

Amanda Lambert, MS, CMC, ALCP

Are Caregivers Paid Overtime During the Holidays?

Lowrie Hilladakis

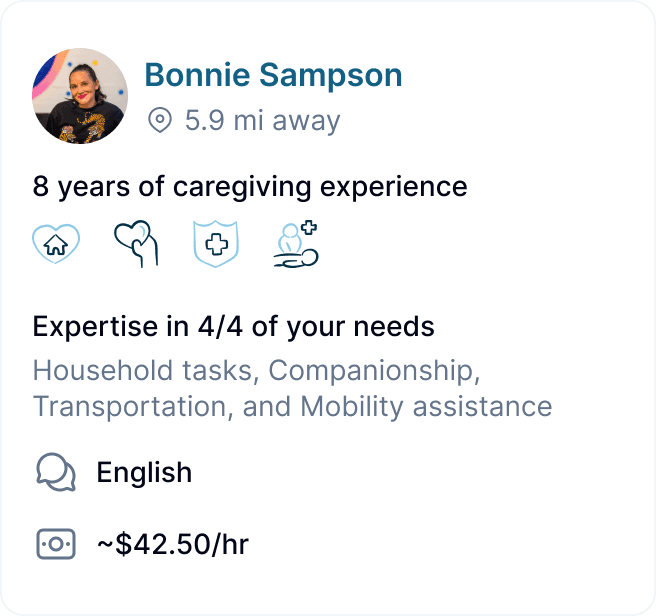

GEt started for free

Better care starts with Clara.

Find, hire, and pay top-notch caregivers without the headache for a price that fits your budget.

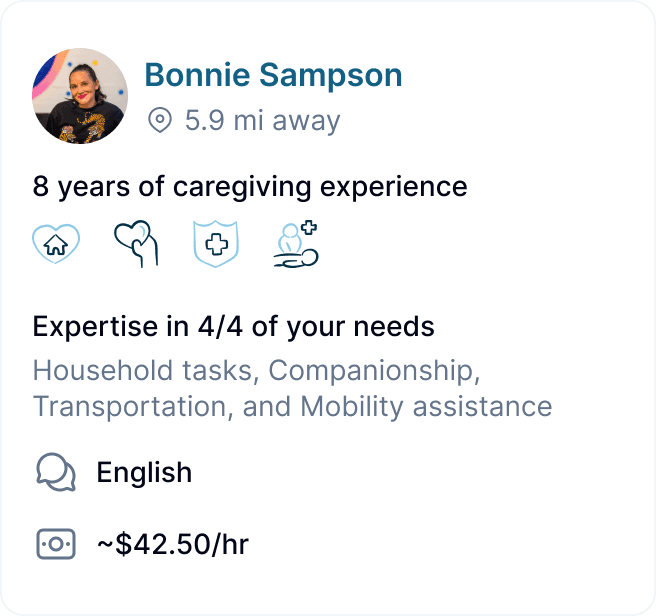

GEt started for free

Better care starts with Clara.

Find, hire, and pay top-notch caregivers without the headache for a price that fits your budget.

GEt started for free

Better care starts with Clara.

Find, hire, and pay top-notch caregivers without the headache for a price that fits your budget.