Payroll & Compliance for Care in California

Dec 13, 2024

Dec 13, 2024

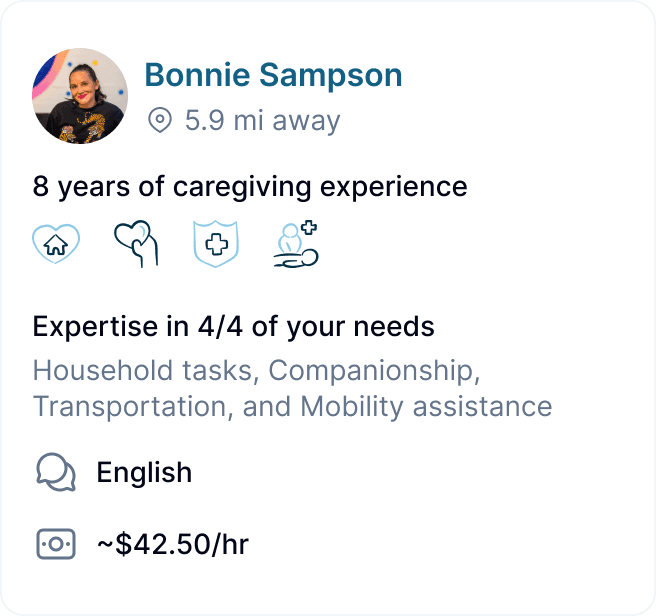

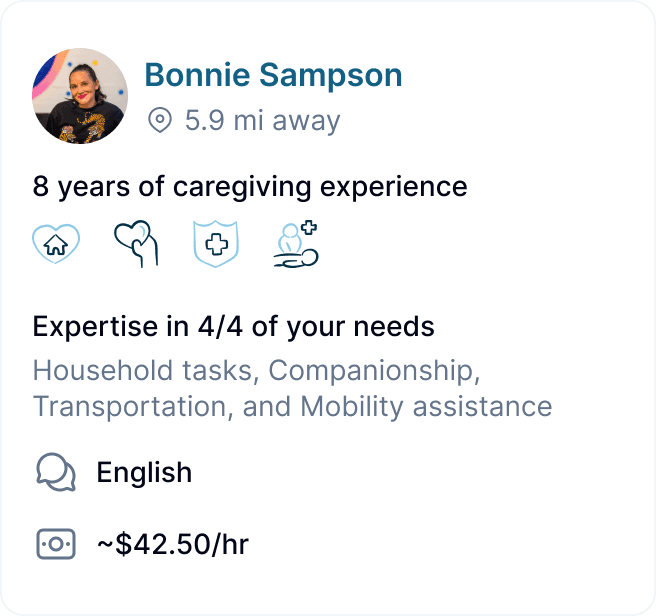

Hiring a private duty in-home caregiver can be a cost-effective way to meet the care needs of your aging loved one. With home care agencies in California charging an average of $37/hr ($45/hr in San Francisco) but employees taking home around $24/hr, you could save over 30% by employing privately. However, as a household employer in California, you must navigate a complex landscape of legal requirements and compliance issues.

This blog post will highlight the challenges and level of effort involved in staying compliant with California law when employing senior caregivers, as well as guide you through the process of hiring independently should you wish to take advantage of the cost savings and enhanced control of private-duty caregiving

Employee Classification

One of the first hurdles you'll face is properly classifying your caregiver. In California, in-home caregivers are generally considered employees rather than independent contractors. This classification is based on the level of control you have over their work, including scheduling, duties, and pay rate. Even if you sign an agreement stating that the caregiver is an independent contractor, courts will look at the actual circumstances of the relationship to determine the proper classification, and will likely find that they are your employee.

Tax Obligations

Once you've classified your caregiver as an employee, you'll need to address various tax obligations:

Federal Taxes:

You're responsible for federal employment taxes when you pay a household worker $2,700 or more in 2024 ($2,600 in 2023)

This includes withholding and paying Social Security and Medicare taxes (FICA), which total 15.3% of wages (split equally between employer and employee)

Federal unemployment taxes (FUTA) apply if you pay $1,000 or more in any calendar quarter

California State Taxes:

If you pay $750 or more in wages in a calendar quarter, you must withhold State Disability Insurance (SDI) from the caregiver's wages

For wages over $1,000 in a quarter, you must also remit Unemployment Insurance and Employment Training Tax payments to the Employment Development Department (EDD)

Registering as an Employer: State and Federal Requirements

When hiring in-home caregivers in California, it's crucial to properly register as an employer at both the state and federal levels. This ensures compliance with tax laws and employment regulations.

Federal Registration - obtain a Federal Employer Identification Number (FEIN) from the IRS

California State Registration - obtain a California Employer Account Number (EAN) from the Employment Development Department (EDD).

Payroll Processing

California law requires that domestic workers, including caregivers, be paid at least twice per month. This means you'll need to process payroll semi-monthly or more frequently. Each pay period, you'll need to:

Calculate hours worked, including any overtime

Determine gross pay

Calculate and withhold appropriate taxes

Issue a paycheck with a detailed pay stub

Overtime and Wage Laws

California has strict overtime laws that apply to caregivers:

Overtime pay (1.5x regular rate) is required for hours worked over 9 in a day or 45 in a week for personal attendants

The first 8 hours worked on the 7th, or more, day of consecutive work are considered overtime (1.5x regular rate). Hours beyond that are 2x regular rate.

You'll also need to comply with California's minimum wage laws, which are generally higher than the federal minimum wage and can vary by location within the state.

Required Notices and Forms

As an employer, you must provide several notices and forms to your caregiver:

Form I-9 for employment eligibility verification

Form W-4 for federal tax withholding

California Wage Notice (Form 2810.5)

Various benefit notices, including unemployment insurance, disability insurance, and paid family leave information

Workers' Compensation Insurance

All California employers are required to maintain workers' compensation insurance coverage for on-the-job injuries.

Homeowner's insurance policies generally do not provide comprehensive workers' compensation coverage for household employees. While some homeowner's policies may offer limited coverage for certain situations involving domestic workers, it is not equivalent to a dedicated workers' compensation policy.

Record Keeping

You must maintain accurate records of hours worked, wages paid, and taxes withheld. These records should be kept for at least three years in case of an audit or dispute.

Conclusion

Employing an in-home caregiver in California comes with significant responsibilities and compliance challenges. The level of effort required to stay compliant with all applicable laws and regulations can be substantial, especially for those unfamiliar with payroll and employment law.

Clara Makes Compliance Simple

When you hire a caregiver through Clara, we help you stay compliant and avoid potential penalties. Clara handles all of the registration, payroll, tax, and insurance requirements for you so that you can focus on caring for your loved one.

Remember, while the compliance process may seem daunting, it's crucial for protecting both you and your caregiver. By following these guidelines and staying informed about your obligations as an employer, you can provide a safe and legal working environment for the person caring for your loved one.

Clara can take this headache off of your plate. Give one of our home care experts a call today at +1 (415) 985-0926, or schedule a call.

Hiring a private duty in-home caregiver can be a cost-effective way to meet the care needs of your aging loved one. With home care agencies in California charging an average of $37/hr ($45/hr in San Francisco) but employees taking home around $24/hr, you could save over 30% by employing privately. However, as a household employer in California, you must navigate a complex landscape of legal requirements and compliance issues.

This blog post will highlight the challenges and level of effort involved in staying compliant with California law when employing senior caregivers, as well as guide you through the process of hiring independently should you wish to take advantage of the cost savings and enhanced control of private-duty caregiving

Employee Classification

One of the first hurdles you'll face is properly classifying your caregiver. In California, in-home caregivers are generally considered employees rather than independent contractors. This classification is based on the level of control you have over their work, including scheduling, duties, and pay rate. Even if you sign an agreement stating that the caregiver is an independent contractor, courts will look at the actual circumstances of the relationship to determine the proper classification, and will likely find that they are your employee.

Tax Obligations

Once you've classified your caregiver as an employee, you'll need to address various tax obligations:

Federal Taxes:

You're responsible for federal employment taxes when you pay a household worker $2,700 or more in 2024 ($2,600 in 2023)

This includes withholding and paying Social Security and Medicare taxes (FICA), which total 15.3% of wages (split equally between employer and employee)

Federal unemployment taxes (FUTA) apply if you pay $1,000 or more in any calendar quarter

California State Taxes:

If you pay $750 or more in wages in a calendar quarter, you must withhold State Disability Insurance (SDI) from the caregiver's wages

For wages over $1,000 in a quarter, you must also remit Unemployment Insurance and Employment Training Tax payments to the Employment Development Department (EDD)

Registering as an Employer: State and Federal Requirements

When hiring in-home caregivers in California, it's crucial to properly register as an employer at both the state and federal levels. This ensures compliance with tax laws and employment regulations.

Federal Registration - obtain a Federal Employer Identification Number (FEIN) from the IRS

California State Registration - obtain a California Employer Account Number (EAN) from the Employment Development Department (EDD).

Payroll Processing

California law requires that domestic workers, including caregivers, be paid at least twice per month. This means you'll need to process payroll semi-monthly or more frequently. Each pay period, you'll need to:

Calculate hours worked, including any overtime

Determine gross pay

Calculate and withhold appropriate taxes

Issue a paycheck with a detailed pay stub

Overtime and Wage Laws

California has strict overtime laws that apply to caregivers:

Overtime pay (1.5x regular rate) is required for hours worked over 9 in a day or 45 in a week for personal attendants

The first 8 hours worked on the 7th, or more, day of consecutive work are considered overtime (1.5x regular rate). Hours beyond that are 2x regular rate.

You'll also need to comply with California's minimum wage laws, which are generally higher than the federal minimum wage and can vary by location within the state.

Required Notices and Forms

As an employer, you must provide several notices and forms to your caregiver:

Form I-9 for employment eligibility verification

Form W-4 for federal tax withholding

California Wage Notice (Form 2810.5)

Various benefit notices, including unemployment insurance, disability insurance, and paid family leave information

Workers' Compensation Insurance

All California employers are required to maintain workers' compensation insurance coverage for on-the-job injuries.

Homeowner's insurance policies generally do not provide comprehensive workers' compensation coverage for household employees. While some homeowner's policies may offer limited coverage for certain situations involving domestic workers, it is not equivalent to a dedicated workers' compensation policy.

Record Keeping

You must maintain accurate records of hours worked, wages paid, and taxes withheld. These records should be kept for at least three years in case of an audit or dispute.

Conclusion

Employing an in-home caregiver in California comes with significant responsibilities and compliance challenges. The level of effort required to stay compliant with all applicable laws and regulations can be substantial, especially for those unfamiliar with payroll and employment law.

Clara Makes Compliance Simple

When you hire a caregiver through Clara, we help you stay compliant and avoid potential penalties. Clara handles all of the registration, payroll, tax, and insurance requirements for you so that you can focus on caring for your loved one.

Remember, while the compliance process may seem daunting, it's crucial for protecting both you and your caregiver. By following these guidelines and staying informed about your obligations as an employer, you can provide a safe and legal working environment for the person caring for your loved one.

Clara can take this headache off of your plate. Give one of our home care experts a call today at +1 (415) 985-0926, or schedule a call.

Hiring a private duty in-home caregiver can be a cost-effective way to meet the care needs of your aging loved one. With home care agencies in California charging an average of $37/hr ($45/hr in San Francisco) but employees taking home around $24/hr, you could save over 30% by employing privately. However, as a household employer in California, you must navigate a complex landscape of legal requirements and compliance issues.

This blog post will highlight the challenges and level of effort involved in staying compliant with California law when employing senior caregivers, as well as guide you through the process of hiring independently should you wish to take advantage of the cost savings and enhanced control of private-duty caregiving

Employee Classification

One of the first hurdles you'll face is properly classifying your caregiver. In California, in-home caregivers are generally considered employees rather than independent contractors. This classification is based on the level of control you have over their work, including scheduling, duties, and pay rate. Even if you sign an agreement stating that the caregiver is an independent contractor, courts will look at the actual circumstances of the relationship to determine the proper classification, and will likely find that they are your employee.

Tax Obligations

Once you've classified your caregiver as an employee, you'll need to address various tax obligations:

Federal Taxes:

You're responsible for federal employment taxes when you pay a household worker $2,700 or more in 2024 ($2,600 in 2023)

This includes withholding and paying Social Security and Medicare taxes (FICA), which total 15.3% of wages (split equally between employer and employee)

Federal unemployment taxes (FUTA) apply if you pay $1,000 or more in any calendar quarter

California State Taxes:

If you pay $750 or more in wages in a calendar quarter, you must withhold State Disability Insurance (SDI) from the caregiver's wages

For wages over $1,000 in a quarter, you must also remit Unemployment Insurance and Employment Training Tax payments to the Employment Development Department (EDD)

Registering as an Employer: State and Federal Requirements

When hiring in-home caregivers in California, it's crucial to properly register as an employer at both the state and federal levels. This ensures compliance with tax laws and employment regulations.

Federal Registration - obtain a Federal Employer Identification Number (FEIN) from the IRS

California State Registration - obtain a California Employer Account Number (EAN) from the Employment Development Department (EDD).

Payroll Processing

California law requires that domestic workers, including caregivers, be paid at least twice per month. This means you'll need to process payroll semi-monthly or more frequently. Each pay period, you'll need to:

Calculate hours worked, including any overtime

Determine gross pay

Calculate and withhold appropriate taxes

Issue a paycheck with a detailed pay stub

Overtime and Wage Laws

California has strict overtime laws that apply to caregivers:

Overtime pay (1.5x regular rate) is required for hours worked over 9 in a day or 45 in a week for personal attendants

The first 8 hours worked on the 7th, or more, day of consecutive work are considered overtime (1.5x regular rate). Hours beyond that are 2x regular rate.

You'll also need to comply with California's minimum wage laws, which are generally higher than the federal minimum wage and can vary by location within the state.

Required Notices and Forms

As an employer, you must provide several notices and forms to your caregiver:

Form I-9 for employment eligibility verification

Form W-4 for federal tax withholding

California Wage Notice (Form 2810.5)

Various benefit notices, including unemployment insurance, disability insurance, and paid family leave information

Workers' Compensation Insurance

All California employers are required to maintain workers' compensation insurance coverage for on-the-job injuries.

Homeowner's insurance policies generally do not provide comprehensive workers' compensation coverage for household employees. While some homeowner's policies may offer limited coverage for certain situations involving domestic workers, it is not equivalent to a dedicated workers' compensation policy.

Record Keeping

You must maintain accurate records of hours worked, wages paid, and taxes withheld. These records should be kept for at least three years in case of an audit or dispute.

Conclusion

Employing an in-home caregiver in California comes with significant responsibilities and compliance challenges. The level of effort required to stay compliant with all applicable laws and regulations can be substantial, especially for those unfamiliar with payroll and employment law.

Clara Makes Compliance Simple

When you hire a caregiver through Clara, we help you stay compliant and avoid potential penalties. Clara handles all of the registration, payroll, tax, and insurance requirements for you so that you can focus on caring for your loved one.

Remember, while the compliance process may seem daunting, it's crucial for protecting both you and your caregiver. By following these guidelines and staying informed about your obligations as an employer, you can provide a safe and legal working environment for the person caring for your loved one.

Clara can take this headache off of your plate. Give one of our home care experts a call today at +1 (415) 985-0926, or schedule a call.

More about paying for care

More about paying for care

What Is The Cost Of In-Home Dementia Care In California?

Ian Gillis

Tax Benefits and Deductions for Family Caregivers: Saving Money While Providing Care

Ian Gillis

Breaking Down Financial Barriers to Senior Care: Tips and Strategies

Jon Levinson

What is Long-Term Care Insurance? How It Can Support Your Loved Ones

Vanessa Bustos

How to Tackle Tough Financial Conversations with Your Aging Parents

Jon Levinson

Home Hospice Care Costs for Older Adults: What You Need to Know

Grady Shumway, MSW, LCSW

Does Medicare Cover In-Home Care for Seniors?

Ian Gillis

Does Medicaid Cover In-Home Care for Older Adults?

Amanda Lambert, MS, CMC, ALCP

Are Caregivers Paid Overtime During the Holidays?

Lowrie Hilladakis

What Are the Costs of In-Home Nursing Care?

Grady Shumway, MSW, LCSW

GEt started for free

Better care starts with Clara.

Find, hire, and pay top-notch caregivers without the headache for a price that fits your budget.

GEt started for free

Better care starts with Clara.

Find, hire, and pay top-notch caregivers without the headache for a price that fits your budget.

GEt started for free

Better care starts with Clara.

Find, hire, and pay top-notch caregivers without the headache for a price that fits your budget.